What is NPV? Formula for calculating NPV

To implement any project, people will need no capital. But how to properly distribute that capital is important. At this point, the financial expert will apply the net present value calculation of NPV.

So what is NPV? What does an NPV mean in assessing the success of a project?

What is NPV?

NPV (Net Present Value) or net present value. This is a term in the financial industry used to refer to the difference in the actual revenue streams of a given project. Simply put, the future cash flow value of a project will be converted to the value of the current cash flow.

People often use NPV calculation in the allocation of capital, to formulate an investment plan of the body. In order to calculate the profit to be earned from a project or any investment.

NPV calculation is based on the idea that the value of the current investment capital is always higher than the future money value. Because of value inflation, profits from other sources of income need to be made at a certain time. In a nutshell, a penny we earn tomorrow is always less than the value of a penny we earn today.

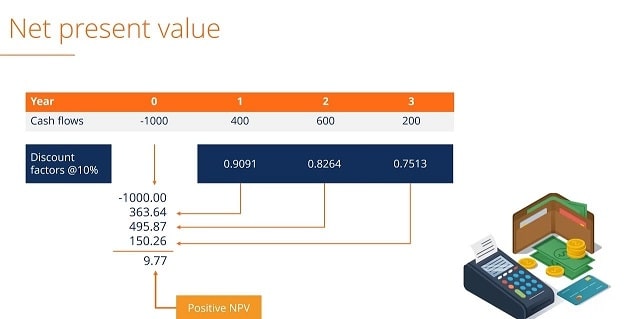

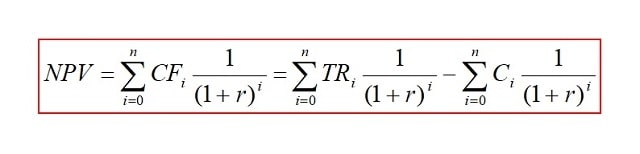

Net present value (NPV) formula

Once you have a good understanding of what NPV is, you should also explore the formula for calculating net NPV. Accordingly, to calculate the NPV, you will apply the formula:

The meaning of each price in the NPV formula:

TRi: The revenue of the project in each year

Ci: Investment cost for the project in each year

r: Project’s discounted interest rate in%

i (can be 1, 2, 3, 4, .. n): Years in which the project will operate

Evaluate the success of a project based on NPV

Based on the NPV results, you will somewhat correlate the success or failure of a future project. Specifically:

Based on the NPV results, you will somewhat correlate the success or failure of a future project. Specifically:

- When NPV value> 0: Indicates that the investment project will have high profitability in the future.

- When NPV value <0: Indicates the project will not be profitable and should not be input into this project.

- When NPV = 0: The project is profitable and able to be invested.

From the above formula you can see that the value of NPV depends greatly on the interest rate of each project. In which, this interest rate changes depending on each project of the business. The investment side cannot apply subjective calculation for the discount rate.

There will not be a common discount rate for all businesses or any project. Because the interest rate calculation should be based on many factors from the market reality

Why is NPV the choice of many experts?

The NPV net present value method is always the choice of many experts when assessing the success of a project. Because firstly, NPV allows to calculate quite in detail the price of capital, profit over time. Because future cash flows have been converted to the value of cash flows at the present time.

In addition, NPV also takes into account capital investment. This allows to partially assess the payback capacity of the project. At the same time, based on NPV, you can also compare the level of capital allocation and the value of the profit will be earned.

In addition to the above advantages, there are still a few shortcomings in the calculation of net present value. For example, the calculation method is still based mainly on estimation, requiring accurate cost data source. And to be honest, NPV is also a bit difficult to explain to people who are not knowledgeable about the financial sector.

Fastloans.PH has just sent you a net present value concept of NPV. Hopefully after this article, you have understood what NPV is!

The article is from Fastloans.PH website: https://fastloans.ph/

Fastloans.PH - Financial advisory website & online loan product comparison in Philippines

Contact information

Address: 330 Sen. Gil J. Puyat Ave, Makati, 1200 Metro Manila, Philippines

Phone: +63282931254

Email: henrick.philippines@gmail.com

Website: https://fastloans.ph/

Follow Fastloans.PH on:

https://www.facebook.com/FastloansatPhilippines

https://www.instagram.com/fastloansph/

https://fastloanph.tumblr.com/

Comments

Post a Comment