What is grace period? The utilities cannot be ignored when borrowing

You have a loan that needs to be paid to the bank but for some reason arises, you cannot repay on time right in the first period and are very worried. Some banks have been implementing grace period in order to support customers who have not been financially prepared to pay debts immediately.

So what is grace period and principal grace period? What should you know about grace period? All will be provided by banktop.vn through the article below.

What is grace period?

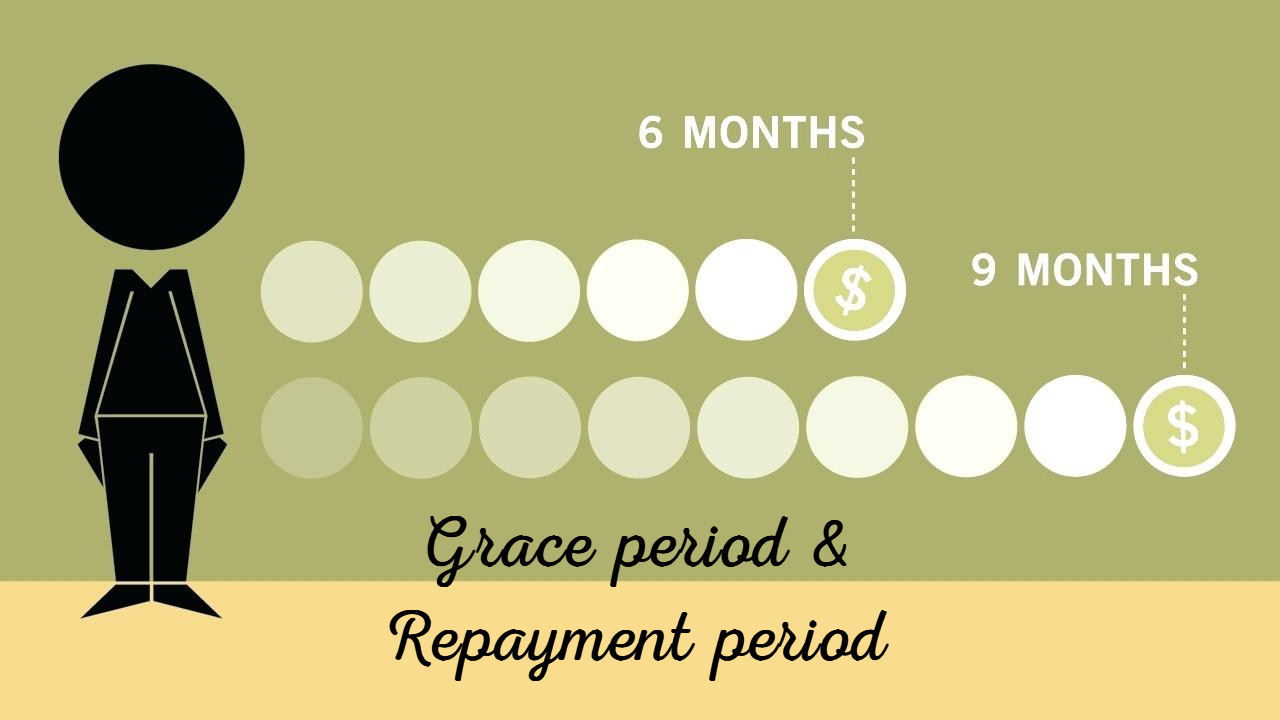

Grace period is the period from the date a customer receives the loan for the first time to before the start of the first repayment period.

During the grace period, there are 2 possible scenarios:

- Customers do not need to pay principal, just pay interest.

- Customers do not need to pay both principal and interest.

The grace period usually lasts from 6 months to 12 months and applies only to long and medium term loans. The grace period is clearly a very good and important benefit to the customer.

What is repayment period

Repayment period is the period from the beginning of the first repayment period until the date of paying off debt (principal and interest) to the bank.

Distinguish between grace period and repayment period

Grace period

The grace period includes the time the customer disburses the capital according to the committed purpose and the trial production period (if any).

This is the period of time when the loan is gradually constituted into the asset value, the ability to exploit the assets formed from the loan capital does not have (or is not high), so the customer has not had to fulfill the obligation to repay the principal. Bank.

Interest arising during the grace period may be paid immediately or later by the customer according to the agreement with the lending bank.

Sources to pay interest arising during the grace period may be equal to equity of the business or loaned by a bank.

Repayment period

Repayment period can be divided into different repayment terms depending on the income situation as well as the repayment ability of the customer.

Repayment term means a period of time during the loan period agreed between the credit institution and the customer at the end of each period that the customer must pay part or all of the loan capital to the credit institution. .

In case the ability to exploit the source of debt repayment at regular intervals, the determination of the repayment period is as follows:

Repayment period (number of repayment periods) = Total loan amount / Repayment amount per period

Payment rate per period = Source of repayment per year / Number of repayment periods per year.

If the customer’s source of repayment is uneven at the repayment terms, the repayment period is determined by the gradual recovery method.

If the customer’s debt repayment source is taken from the full depreciation recovery (or the depreciation formed from the loan capital if agreed), a part of the profit obtained from the loan project and other sources of capital ( if).

Distinguish between forms of principal grace

As noted above, there are two forms of principal grace period. So what are the specific features of these two forms?

Exemption from paying both principal and interest

This principal grace period means that during the grace period, customers do not have to pay any principal or interest to the bank. And at the end of the grace period, new customers must be obliged to pay for unsecured loans, mortgage loans with loan aid units (banks, finance companies).

Principal exemption

True to the name of this form, during the grace period, customers are only exempt from principal and interest is still paid normally. The advantage of this method is that at the end of the grace period, you have paid part of the interest and reduces the financial pressure.

Specific example of the grace period for principal

We will take an example to better understand grace period.

Customers borrow 50.000 PHP unsecured loans, the loan period is 24 months under the contract. Original paid monthly. The grace period of principal and interest is 6 months. The interest rate is 10% / year. We have an illustration table as follows:

| Month | Principal | Interest | Note |

| 1 | 0 | 0 | Grace period |

| 2 | 0 | 0 | Grace period |

| 3 | 0 | 0 | Grace period |

| 4 | 0 | 0 | Grace period |

| 5 | 0 | 0 | Grace period |

| 6 | 0 | 0 | Grace period |

| 7 | 2.777 | 416 | |

| 8 | 2.777 | 416 | |

| 9 | 2.777 | 416 | |

| 10 | 2.777 | 416 | |

| 11 | 2.777 | 416 | |

| 12 | 2.777 | 416 | |

| 13 | 2.777 | 416 | |

| 14 | 2.777 | 416 | |

| 15 | 2.777 | 416 | |

| 16 | 2.777 | 416 | |

| 17 | 2.777 | 416 | |

| 18 | 2.777 | 416 | |

| 19 | 2.777 | 416 | |

| 20 | 2.777 | 416 | |

| 21 | 2.777 | 416 | |

| 22 | 2.777 | 416 | |

| 23 | 2.777 | 416 | |

| 24 | 2.777 | 416 |

Thus, the table above is a detailed illustration of a specific case of grace period when borrowing cash with monthly installments.

Important notes when conducting loan principal grace period

In order to get the fastest repayment of principal, customers need to express their wishes to the bank. In this case, depending on your own economic conditions, you will be supported with the appropriate form of grace.

- The customer should pay attention to the amount of principal and interest payable during the grace period as it depends on the agreement between the customer and the bank in the contract. Some cases are as follows:

- The principal amount is not payable during the grace period, but the principal amount will be divided equally among the remaining terms. Interest depends on whether or not the grace period.

- If the principal and interest are both graceful, the interest arising in the grace period will be accrued to pay one time at the first repayment term.

If the interest is not graceful, the interest must be paid according to the terms calculated and determined in the contract.

So, when customers get loans at the bank, do not forget to learn about the principal grace period? As well as calculating the amounts payable when enjoying grace period. Read your credit agreement carefully and become a smart borrower, making the most of the offers and benefits you receive.

Summary

Above is the necessary information to help customers answer the question “What is grace period?” when borrowing money from a bank. Hope this article has provided you with useful information to have a great financial plan.

See also: BSP requires banks, financial firms to offer 60-day grace period for loan payments

The article is from Fastloans.PH website: https://fastloans.ph/

Fastloans.PH - Financial advisory website & online loan product comparison in Philippines

Contact information

Address: 330 Sen. Gil J. Puyat Ave, Makati, 1200 Metro Manila, Philippines

Phone: +63282931254

Email: henrick.philippines@gmail.com

Website: https://fastloans.ph/

Follow Fastloans.PH on:

https://www.facebook.com/FastloansatPhilippines

https://www.instagram.com/fastloansph/

https://fastloanph.tumblr.com/

Comments

Post a Comment