What is forex? 7 fundamental definition about forex

Have you ever wonder what is forex? Investing in Forex is easy for those who want to be active in their capital and cross-border investments. Recently, this has been concerned by many investors due to their belief in the ability to quickly profit. However, not everyone understands and achieves success when investing in foreign exchange.

What is forex?

So what is forex? The foreign exchange market (Forex, FX, or money market) is a global decentralized marketplace for the exchange of currencies. The main players in this market are the major international banks. Financial centers around the world function as anchors of exchange between a wide range of different types of buyers and sellers around the clock, except on weekends.

See also: What is inflation? Inflation rate 2019 Philippines

Features of the Forex market

The foreign exchange market has the following special features:

- Its huge trading volumes represent the world’s largest asset classes resulting in high liquidity;

- Its geographic dispersion;

- Its continuous operation: 24 hours a day, except on weekends depending on the season;

- The variety of factors influencing exchange rates;

- The margins of relative returns are low compared to other fixed income markets;

- Use leverage to increase margins and losses and to account size;

Forex market has vast advantages and large, continuous trading volume, high liquidity, less bad debt are also advantages of this market form.

Best of all, Forex does not have the same trading time restrictions as the stock market. Thanks to this advantage, investors can easily execute currency trading orders without having to wait until the next session opening time to match orders.

Time and scale of foreign exchange market operations

The foreign exchange market is an “interbank” market, and is based on electronic transactions between a system that connects banks and operates 24 hours a day. Forex is open 24 hours a day, 5 days a week, and is traded from 20:15 GMT on Sunday until 22:00 GMT on Friday, except weekends.

This is the largest financial market in the world, with the amount of money traded per day has reached nearly 3.95 trillion USD. If we compare the New York stock market of 25 billion USD traded per day, we will see how huge this market is.

The attraction of Forex on investors

- The capital spent to participate in the Forex market does not need to be too much.

- Easy access to knowledge about Forex.

- Forex market is open 24/7 for 5.5 days a week.

- You can trade anytime the market is open without any restrictions.

- You can trade anywhere with just a laptop or even a mobile device and internet connection.

Forex Forex operations in Philippines

The nature of Forex trading (or forex trading floor) is trading in forex via an account, in the form of margin trading, and the net value is constantly revalued according to the fluctuations of exchange rates. money or commodity prices, including gold.

Members of the currency exchange business make money in the Forex market by buying bullish currency pairs and selling falling currency pairs. That difference is the profit of the trade. The possibility of making a profit always exists because exchange rates are always fluctuating.

Foreign exchange is understood to include foreign currency which is the currency of another country or the common currency of Europe and gold including gold on the account. Trading on the forex floor is not the activity of buying and selling foreign exchange to serve the needs of using foreign exchange, but the activity of buying and selling foreign exchange to speculate on price fluctuations.

Basic terms in Forex investing

Currency, currency pair

A national currency is the unit of the national currency of a country or a group of countries (for example, the Euro in Western Europe, the US dollar, the Yen in Japan).

An exchange rate between two currencies shows how much one currency is valued against in another

Margin trading

Margin trading is a financially leveraged activity that allows many individual investors to participate in the foreign exchange market with a certain amount of initial capital. Brokers will provide leverage to their clients at a rate and at a certain fee.

See also: Find out what margin trading is if you don’t want to take risks

PIP

The PIP is the Percentage In Point which is the smallest unit of fluctuation of a rate. The profit or loss that investors lose will be determined based on the percentage change from the start of the trade.

Gap

The difference between the buying and selling prices. For example, if the buy price of the USD / CHF pair is 1.2212 and the corresponding ask price is 1.2215 at 10:00 a.m. then the spread is three percentage points.

Market trend

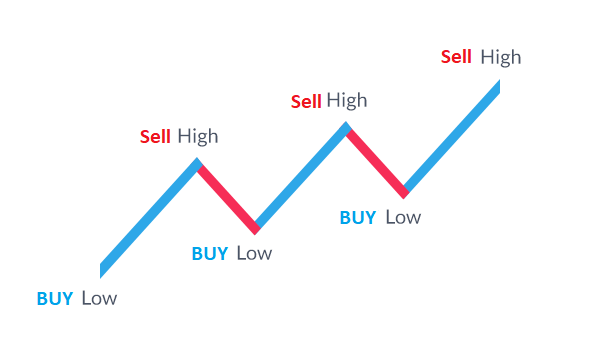

Market trend is the concept that indicates the next direction of the Forex market, there are 3 types of trends: up, down and sideways. This will lead to market concepts such as “Bullish” and “Bearish” markets. Market participants who trade according to the above 2 trends are called:

- Bulls: Buy and expect prices to rise.

- Bears: Expect prices to go down and they sell.

Exchange rate

Some of the terms exchange rate (quotes) are commonly used in Forex trading such as: direct rate, indirect rate, cross rate.

- Live quotes: On the Forex forex market, the live quote means a foreign currency that is quoted in US dollars (eg EUR / USD, CHF / USD).

- Indirect Quote: Means the US dollar is quoted in a certain amount of another foreign currency (eg USD / EUR or USD / CHF).

- Cross-rate: Means a unit of a foreign currency that is quoted in a certain amount of another currency (eg EUR / CHF, GBP / JPY, EUR / JPY…).

Foreign currency exchange

Foreign currency swap is the operation of simultaneously buying and selling a certain amount of foreign currency with two different terms. Foreign currency swaps can be done on the interbank market or between a bank and a customer (individual or business).

Charts

Charts are the most common way to simulate and analyze exchange rate movements. Currently, there are a number of charts that many Forex traders use as one of their market analysis tools such as:

- Line chart.

- Bar chart.

- Japanese candlestick chart.

Trading on the Forex market as well as other financial transactions always involves quite high risks. Especially markets that allow the use of financial instruments blind individual investors because of paranoia about the possible returns. In particular, investors who are not knowledgeable about the market will increase their risk.

Therefore, in addition to understanding the above background information, investors need to have a clear capital source and trading plan when participating in the Forex market. In particular, always remember, control your greed.

Is forex illegal in Philippines?

If you live in the Philippines and want to trade foreign exchange, you should know that the Securities and Exchange Commission of the Philippines (SEC) has taken a rather unfavorable stance on forex trading due to reports of fraud and retail traders heavy losses. In fact, the SEC has issued two pieces of advice in recent years stating that forex trading is illegal to prevent individuals and local brokers from engaging in Forex trading. .

Forex trading may not be legal in the Philippines, so you may not be able to find a local broker that allows you to trade currencies. Even so, you can still find an international online broker based outside the Philippines to trade foreign exchange.

Hope this article will help you to understand clearly about what is forex.

The article is from Fastloans.PH website: https://fastloans.ph/

Fastloans.PH - Financial advisory website & online loan product comparison in Philippines

Contact information

Address: 330 Sen. Gil J. Puyat Ave, Makati, 1200 Metro Manila, Philippines

Phone: +63282931254

Email: henrick.philippines@gmail.com

Website: https://fastloans.ph/

Follow Fastloans.PH on:

https://www.facebook.com/FastloansatPhilippines

https://www.instagram.com/fastloansph/

https://fastloanph.tumblr.com/

This comment has been removed by the author.

ReplyDelete